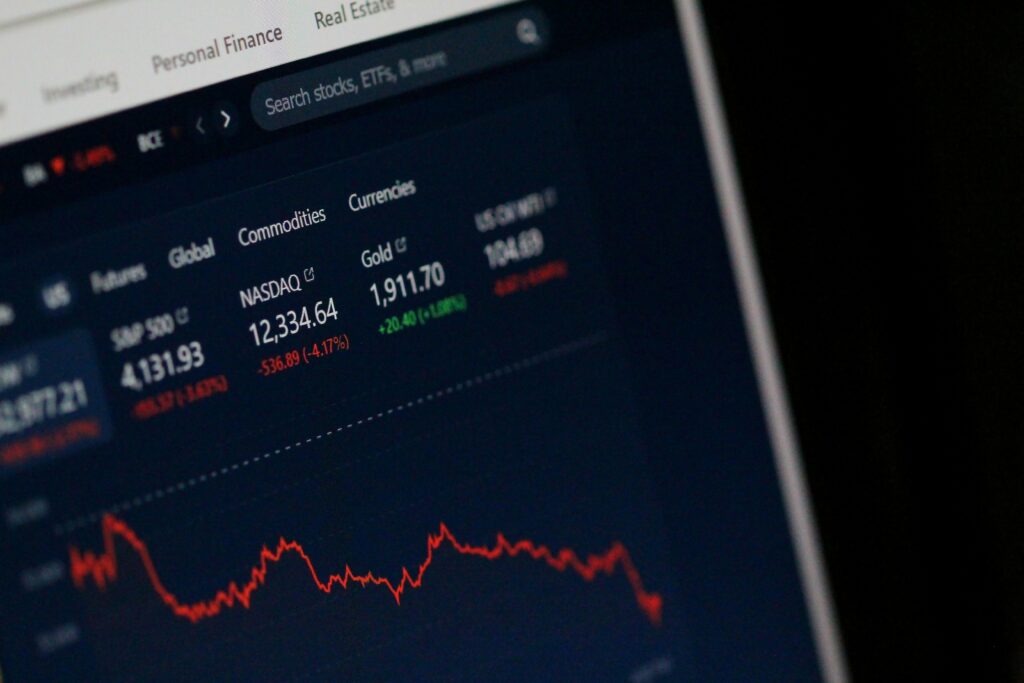

The Sensex ended at INR 77,378, with a small decline from the previous day. Though TCS jumped by more than 5.5% after posting strong Q3 results, and Tech Mahindra rose by over 3%, it could not offset the heavy losses in other sectors. Shriram Finance was down by more than 5.3% and pulled the index down. IndusInd Bank and Adani Enterprises fell by 4% and 3%, respectively. Other major losers were NTPC, BEL, and UltraTech Cement, which are dragging the market sentiment down.

Nifty 50 Struggles Amid Gainers and Losers

The Nifty 50 index ended the session at INR 23,431, lower by a tad from its previous close. While the index remained mixed, gains from TCS and Tech Mahindra could provide some comfort. However, losses from stocks such as Shriram Finance, IndusInd Bank, and Adani Enterprises, along with weakness in sectors such as power and cement, overshadowed gains. The market seemed cautious ahead of corporate results and global cues.

Advertisement

The Nifty Bank index closed at INR 48,772 with a drop of more than 1.4%. Among financial majors, HDFC Bank, ICICI Bank, and Kotak Mahindra Bank declined with decent fall also noted in Axis Bank and SBI. However, on account of a strong fundament among banks, profit booking along with a weak overall market mood made the sector face the brunt.

The Nifty Next 50 index ended at INR 64,234, witnessing a sharp fall of over 2%. Heavy contributors to this downtrend were REC, which fell by more than 6%, and BHEL, which also declined by 6%. Stocks like Union Bank, PFC, DLF, Adani Green, PNB, and Canara Bank witnessed heavy selling, pushing the index further into negative territory.

On the last day of the week, the BSE 200 closed at INR 10,697, which marked another deteriorating session with losses. Major laggards were AWL, which saw a steep fall of above 9%, and GIC Re, which fell by more than 7%. In a similar way, Tata Elxsi and IREDA declined by over 6% and diminished by all the other stocks’ gains.

Overall, the market was somewhat subdued today as all major indices closed lower. Top performer of the day was TCS, most likely due to the strong Q3 results and offering some respite to tech stocks. Even stocks like IREDA and Tata Elxsi, who had declared their quarterly earnings, saw heavy selling pressure, and the investor anxiety reflected in those sales. Caution remains prevalent in the market, and all market participants are now waiting to see the further cues from upcoming corporate results and global developments.

Disclaimer: The information provided is for educational purposes only and does not constitute financial advice. We are not registered financial advisors. Please conduct your own research and consult a qualified advisor before making investment decisions. Any investment decisions you make based on this information are solely at your own risk.

Also read: Tata Elxsi and TCS Declaring Q3 Results

Published on: January 9, 2025 at 9.00PM GMT.

Vaikunta Ekadasi Parana Time:

The time for breaking the fast for Vaikunta Ekadasi would be on January 11, 2025, between 7:14 AM-8:21 AM. Devotees consider this time for the last bath and offering of prayers and rituals to Lord Vishnu in the conclusion of their fast.

As stated in Bhagavad Gita : (Bhagavad Gita 6.5)

उद्धरेदात्मनात्मानं नात्मानमवसादयेत्।

One must elevate, not degrade, oneself; the mind is the friend of the conditioned soul, and his enemy as well.

11th January is celebrated as Human Trafficking Awareness Day!